Elon Musk’s first tech company was Zip2, a software company that he co-founded in 1995. Zip2 was an online city guide that provided searchable business directories and maps.

Musk co-founded Zip2 with his brother Kimbal and Greg Kouri. PayPal co-founder Elon Musk was just 23 when he and his younger brother, Kimbal, met Kouri, a friend of their parents, in Toronto in 1995. The brothers moved to Silicon Valley, and Kouri helped them launch a startup, Zip2, an early door-to-door direction service. Kouri became vice-president of business development. The company was originally called Global Link Information Network.

Gregory (Greg) Anthony Kouri, 51, passed away suddenly on Saturday, August 11, 2012 in New York City.

Compaq’s AltaVista division bought the company in 1999 for $307 million, and the Musks and Kouri plowed some of the proceeds into X.com, an online financial services company. In 2000, Musk merged it with a payments startup called Confinity, led by Peter Thiel. Musk received $22 million for his 7% share.

Elon Musk co-founded X.com, which merged with Confinity to form PayPal in 2000. He was briefly the CEO of PayPal before being ousted by the board in 2000. Musk remained the largest shareholder of PayPal after being ousted as CEO. In 2002, eBay acquired PayPal for $1.5 billion, netting Musk $165 million.

And now…

Elon Musk just took another step toward turning X into a financial powerhouse. The platform is rolling out X Money, a digital wallet and peer-to-peer payment service backed by Visa (NYSE:V). This means X users can now move money between their bank accounts and X’s ecosystemjust like Zelle or Venmo. CEO Linda Yaccarino confirmed Visa as the first financial partner, making it clear that X is dead serious about integrating payments into the app. With X Payments LLC already licensed in 41 states, the groundwork is in place for Musk’s vision of a fully integrated financial network.

Elon Musk is intent on becoming a competitor with PayPal, a company he helped to found after rebranding twitter, X, after one of his earlier companies.

—————–

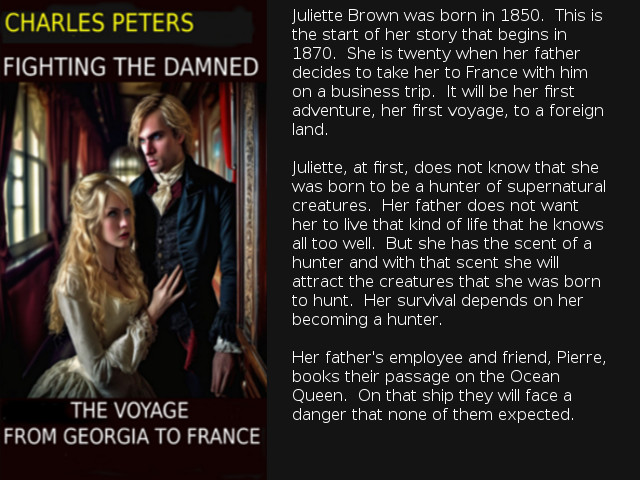

If you wish to support me, please consider buying one of my eBooks.

I receive the most money if you buy The Suspense Account & Flame By The Sea for $8.99.

Some of my eBooks range in price from 99 cents, to $2.99, to the $8.99

My Author Page on Amazon is located here.