Key Points from cnbc.com:

Target executives cited the recent U.S. ports strike and need to bring goods ahead of it as a factor in its big earnings miss on Thursday, due to elevated freight costs and overly stocked stores.

Trade data reviewed by CNBC shows Target imported a level of goods this year across key months in advance of the strike that was similar to 2023′s peak shipping season, essentially flat to down in the overall number of cargo containers.

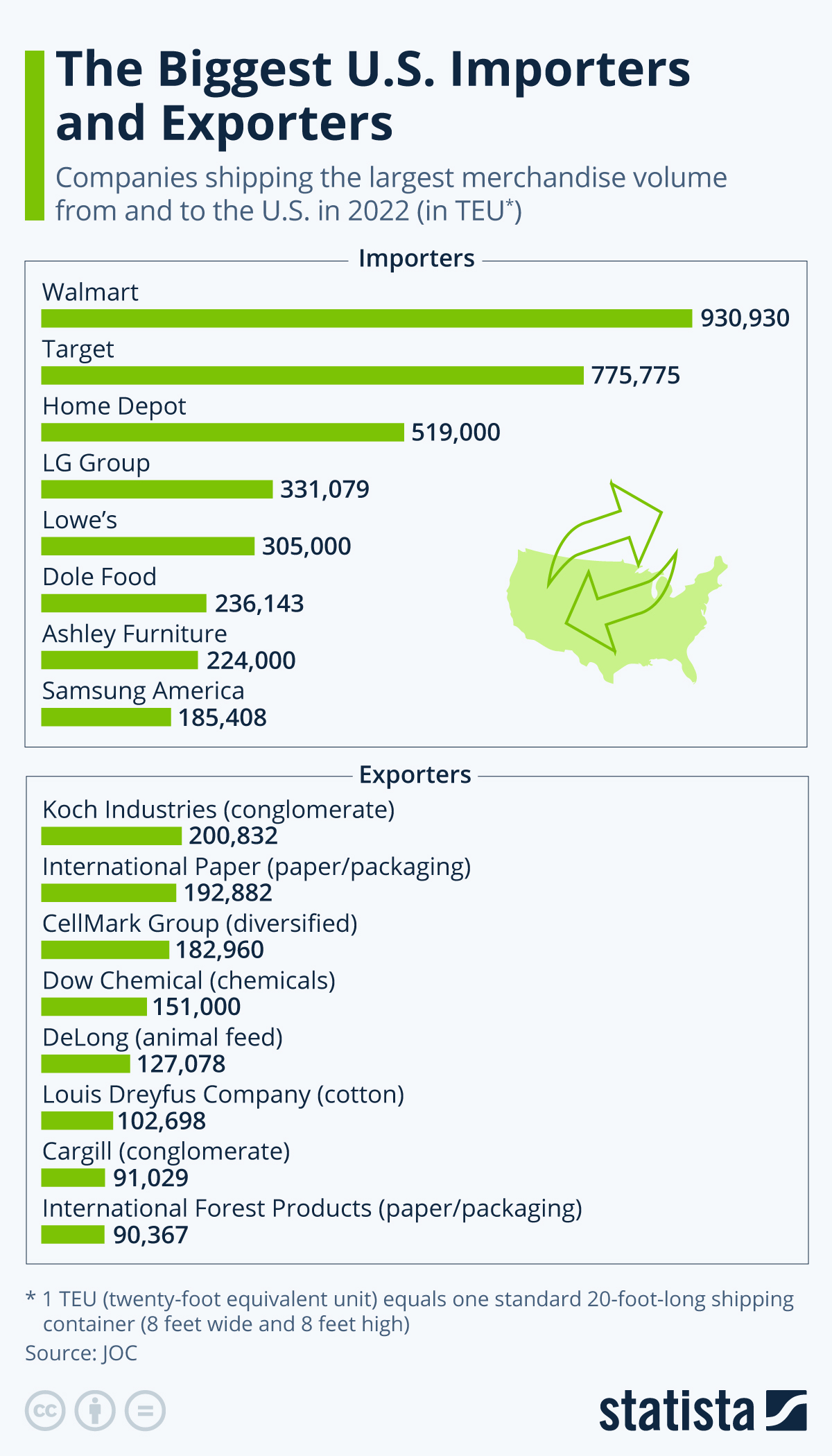

The data also shows that the value of goods Target imported was higher than at Walmart by $1.2 billion, reinforcing the real problem for the retailer: it missed on its forecast for consumer demand and price-point sensitivity.

So what did hurt Target compared to last year?

It is trying to be a higher end retailer than Walmart with products that consumers may buy or leave on the shelf depending on how economically stressed their consumer is. Target’s foot traffic has continued to increase but their customers are not jumping at the products on the shelf. I can’t get a good figure on Target’s ad spend for 2024 but in 2023 they spent $1.4 billion which going back 14 years, that tends to be what they consistently spend on advertisements. Walmart which has always boasted a “no sales” strategy but boast regular pricing spends around $3.4 billion on ads. Target does run sales. Target does issue rainchecks on sale items it does not have in stock so long as they are not clearance, price cut items, or so called everyday low price items. I can not find the number of rainchecks they have recently been issuing which would indicate inventory problems or potential customer dissatisfaction because of an item on sale not being in stock or the perception that there might be a switch and bait strategy going on where the customer comes in for an item on sale but ends up buying a similar but higher priced item.

Both Walmart and Target are highly dependent on imports and with shipping cost unstable and often high in today’s market.

It is hard to get current numbers on the clothing market, but in 2023 the clothing market was in a recession.

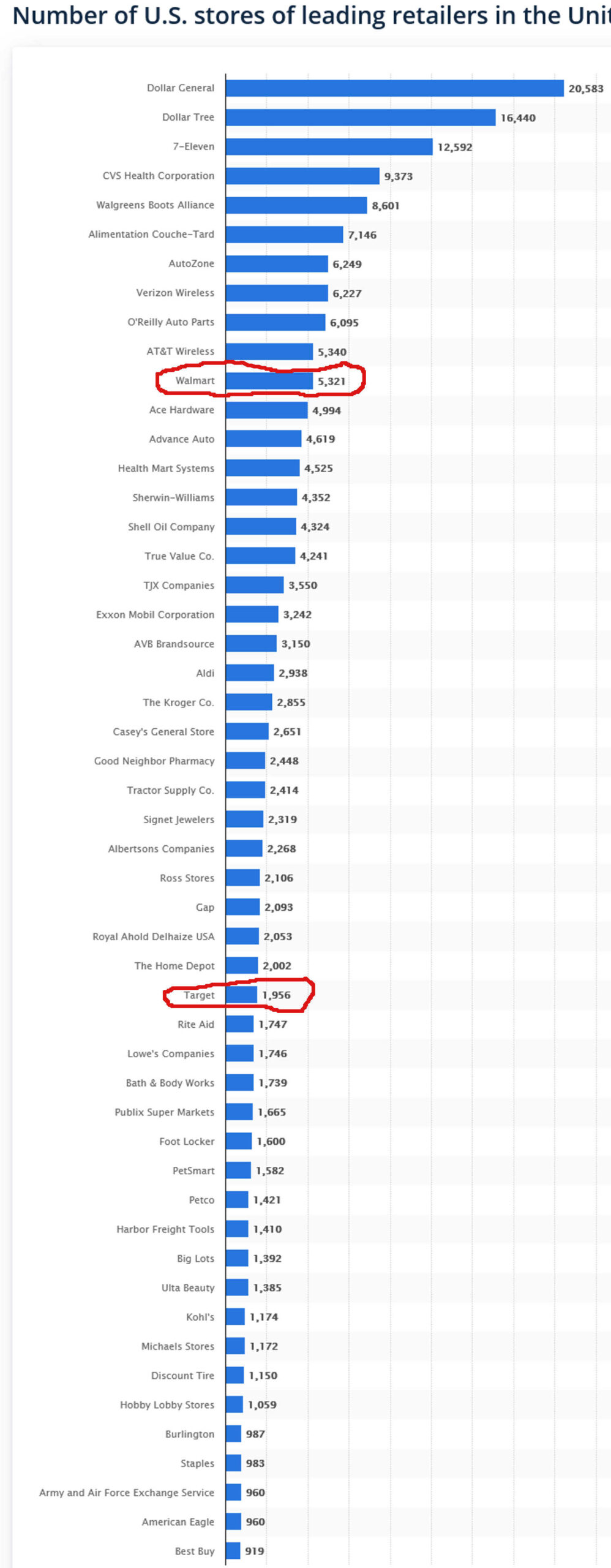

The number stores that different retailers have.

At the moment of this writing Target share price is $122.99

Did Target intentionally mislead on the earnings miss? I think Target’s explanation was valid in that they are worried about inventory disruptions and probably have been going back to 2019. During the Covid years there were a lot of empty shelves at a lot of retailers. Their latest concern probably was the ports strike.

The best way to support me is to buy one of my eBooks. Some contain erotica but not all of them.

My Amazon Author Page:

https://www.amazon.com/stores/Charles-Peters/author/B00E62DK4Q